Enhanced Infrastructure Financing Districts

County of Riverside EIFD

Enhanced Infrastructure Financing Districts (EIFDs) were introduced by the California Legislature from 2014-2015, enabling a new model for financing infrastructure and economic development in California.

Riverside County is forming an EIFD to allow funds generated to be re-invested in a designated area. These revenues serve as a dedicated source of public funds for improvements. Some proceeds will be used to pay the amount required to cover the repayment of municipal bonds issued by the EIFD.

Why Form an EIFD?

Targeted Infrastructure Improvements

Answer:

Using future tax increment revenues serves as a dedicated source of public funds for infrastructure projects within the boundaries

Bundle Other Revenues

Answer:

Allows a variety of revenue sources to be combined, including sales tax, property tax, development impact fees, developer contributions, benefit assessments (CFD)

Attract Additional Funds

Answer:

Allows community to attract tax increment from other entities (cities, special districts), federal/state grants and loans

Return on Investment

Answer:

Private sector investment induced by EIFD commitment accelerates growth of net fiscal revenues and essential infrastructure improvements

Investor Confidence

Answer:

District provides long term committed revenues within the boundaries

**THIS IS NOT A NEW TAX OR FEE AND IT DOES NOT INCREASE PROPERTY TAXES

EIFD Law

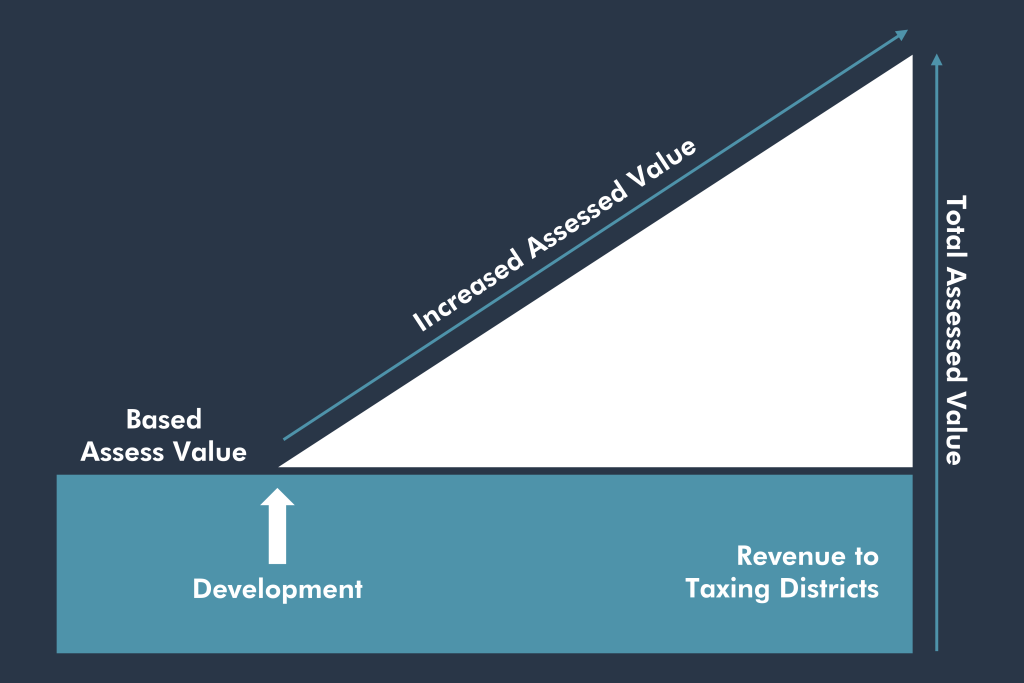

Government Code Sections 53398.50 through 53398.88 (EIFD law) authorizes EIFDs to issue bonds to finance public capital facilities. The available revenue for bonding is the increment of property tax and vehicle license fees within the established boundary, starting from the Fiscal Year after the ordinance to form the EIFD is passed. An EIFD is not a new tax imposed on property owners

EIFD Fundamentals

QUESTION |

ANSWER |

||

Governance: |

Government Code Section 53398 – 53398.88 |

||

Authority: |

Public Finance Authority (PFA) oversees the EIFD financing and activities. Implements Infrastructure Finance Plan (IFP) which is the investment plan of the EIFD |

||

Eligibility: |

County, City, Special District; school districts increment is exempt |

||

Approvals: |

3 Public hearings prior to adopting IFP; no public vote to issue debt |

||

Eligible: Projects |

Infrastructure with a useful life of 15+ years that provide community-wide benefit. Includes: purchase, construction, expansion, improvement, and maintenance |

||

Term: |

45 years from 1st bond issuance |

***DOES NOT INCREASE PROPERTY TAXES

The Governing of an EIFD

EIFDs do not create a new tax nor does it result in any new taxes or fees to the property owners. The EIFD allows for a reallocation of future property taxes to a separate account to be used to pay for Infrastructure improvements that benefit a designated area.

The approval of an EIFD is based on local elected official's vote to form the EIFD and create a Public Financing Authority (PFA). The PFA Board serves as the governing body to implement the EIFD projects that are listed in the Infrastructure Financing Plan (IFP). Although there is no public vote to form an EIFD, there are 3 public hearings held by the PFA where property owners can provide feedback and voice any concerns. At the final hearing, the PFA Board (made up of 3 Supervisors and 2 members of the public) will vote on whether to form the EIFD or delay proceedings based on any protest received.

EIFD's can last as long to collect and spend property tax increment up to 45 years after the first bond is issued.

Types of Projects & Uses

The types of project EIFD can fund.