Term: The Special Tax shall be levied annually in perpetuity unless terminated earlier by the County.

Finances: (i) Landscaping improvements that may include, but are not limited to all landscaping material and facilities within the CFD. These improvements include turf, ground cover, shrubs, trees, plants, irrigation and drainage system, ornamental lighting, masonry walls or other fencing, and trail maintenance. (ii) Street lighting maintenance, which includes energy charges, operation, maintenance, and administration of street lighting located within the designated boundaries of the CFD. (iii) Administration, inspection, and maintenance of all stormwater facilities and BMPs to include: water quality basins, fossil filters, basin forebays, and all other NPDES/WQMP/BMP related devices and structures as approved and accepted by the Community Facilities District; administration includes, but is not limited to, quality control and assurance of inspections and maintenance, general contract management, scheduling of inspections and maintenance, and general oversight of all NPDES/WQMP/BMP operations; inspection includes, but is not limited to, travel time, visual inspection process and procedures for functionality, GPS location recording, assurance of proper vegetation, functioning irrigation, and citing operational or structural deficiencies, erosion, trash, silt and sediment build-up; and maintenance includes, but is not limited to, repair or replacement of any deficiencies noted during inspection, weed control and abatement, trash removal, and healthy upkeep of required plant materials. (iv) Graffiti abatement of walls and other permanent structures. (v) Enhanced sheriff services to include, but not be limited to, specialized and targeted enforcement within the boundaries of CFD 22-6M, which is in addition to those provided in the territory of the district before the district was created.

The Notice of Special Tax: The annual levy is $990 for Special Tax A and $ 120 for Special Tax B per Single Family Property for Fiscal Year 2022-2023 however, commencing July 1, 2023, this amount shall be increased annually based on the percentage increase in the Consumer Price Index with a minimum annual increase of two percent (2%). The Notice of Special Tax Lien has been recorded for the above referenced project. Recording information is as follows: 2/1/23 Document # 2023-0030164

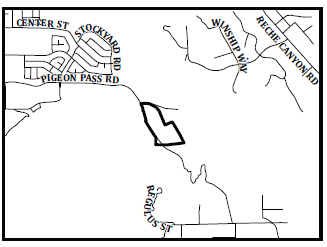

Tract: 33410