Highway 74 EIFD

Enhanced Infrastructure Financing Districts (EIFDs) were introduced by the California Legislature from 2014-2015, enabling a new model for financing infrastructure and economic development in California. Government Code Sections 53398.50 through 53398.88 (EIFD law) authorizes EIFDs to issue bonds to finance public capital facilities. The available revenue for bonding is the increment of property tax and vehicle license fees within the established boundary, starting from the Fiscal Year after the ordinance to form the EIFD is passed. An EIFD is not a new tax imposed on property owners

Project Overview

Riverside County has initiated the process of establishing an Enhanced Infrastructure Financing District (EIFD) for the Highway 74 area. The Purpose of the EIFD is to establish a funding mechanism that can finance the planning, design, and construction of infrastructure in the Highway 74 area.

THE ESTABLISHMENT OF THE EIFD WILL NOT RESULT IN ANY NEW TAXES OR FEES TO THE PROPERTY OWNERS

Once established, the incremental property taxes collected by the County in the EIFD area above the amount collected in the base year (expected to be 2022) would be specifically used to fund the infrastructure projects listed in the Infrastructure Financing Plan (IFP).

Draft Infrastructure Financing Plan

ENHANCED INFRASTRUCTURE FINANCING DISTRICT HIGHWAY 74 - JULY 1, 2022

POSTED JULY 14, 2022 - Click Below To View Draft Infrastructure Financing Plan

TABLE OF CONTENTS

SECTION

-

INTRODUCTION - Page 1

-

HIGHWAY 74 PROJECT AREA & PUBLIC FACILITIES DESCRIPTION - Page 3

-

EIFD FINANCING PROGRAM - Page 8

-

EIFD FISCAL IMPACTS - Page 13

-

EIFD GOALS AND RESIDENTIAL DEVELOPMENT - Page 14

APPENDICES

APPENDIX A

LEGAL DESCRIPTION AND MAPAPPENDIX B

TAX INCREMENT REVENUE PROJECTIONS AND BONDING CAPACITY ANALYSISAPPENDIX C

HIGHWAY 74 FISCAL IMPACT ANALYSIS

Highway 74 EIFD Public Financing Authority

Public Meetings

The County of Riverside Board of Supervisors has established a separate body, the Highway 74 EIFD Public Financing Authority (PFA), to oversee the creation of the EIFD and to consider the IFP based upon public comment. Any member of the may public may attend the PFA meetings to provide comments. Meeting locations and times will be posted on this website. Additionally, you may submit comments below by clicking on the following button or you can mail them directly to the Highway 74 Financing District, Public Financing Authority, Attn: Mike Franklin at 3403 10th Street, Ste. 400, Riverside, CA 92501.

Meeting Dates

All meetings occur at the County Administration Center at 4080 Lemon Street, Riverside, CA.

|

|

||

|

|

||

|

|

||

|

|

||

|

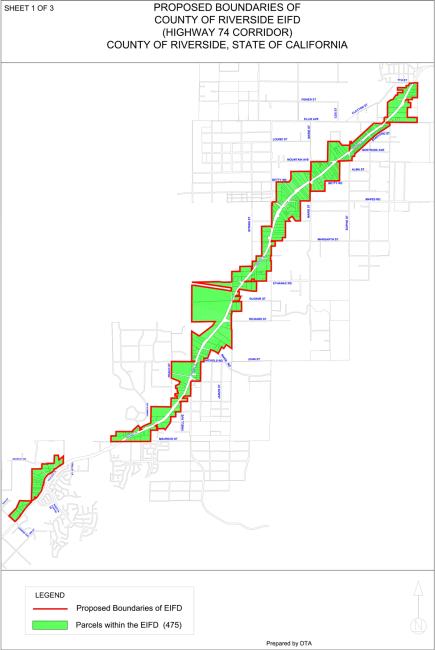

Boundary Map

Please click on the following link below to view a complete boundary map of Highway 74 EIFD

Frequently Asked Questions

Below are frequently asked questions.

What is an EIFD?

Enhanced Infrastructure Financing Districts (EIFDs) are districts with defined boundaries that use local property taxes to issue bond to fund infrastructure projects (e.g. streets, public safety enhancements, trails, signage). EIFDs can be formed among any entities with property taxing authority, including County, City, or Special District, but excludes school districts.

Does an EIFD create a new tax?

NO. The establishment of an EIFD will not result in any new taxes or fees to the property owners. The EIFD allows for a reallocation of future property taxes to a separate account to be used to pay for Infrastructure improvements that benefit a designated area.

Why is the County forming an EIFD?

The EIFD allows funds generated to be re‐invested in a designated area. These revenues serve as a dedicated source of public funds for improvements. Some proceeds will be used to pay the amount required to cover the repayment of municipal bonds issued by the EIFD.

Who approves an EIFD?

The local elected officials vote to form the EIFD and create a Public Financing Authority (PFA). The PFA Board serves as the governing body to implement the EIFD projects that are listed in the Infrastructure Financing Plan (IFP). Although, there is no public vote to form an EIFD, there are 3 public hearings held by the PFA where property owners can provide feedback and voice any concerns. At the final hearing, the PFA Board (made up of 3 Supervisors and 2 members of the public) will vote whether to form the EIFD or delay proceedings based on any protest received.

How long does an EIFD last?

An EIFD can collect and spend property tax increment up to 45 years after the first bond is issued.